The Coronavirus Disease (COVID-19) continues to spread across the globe causing wide-spread anxiety and disruption to organizations, including voluntary and involuntary quarantines. Property and casualty (P&C) insurance companies could incur insurance underwriting losses directly as a result of the outbreak. However, potential losses are not limited to insurance underwriting losses. Equity market fluctuations and cuts in interest rates by central banks to limit the economic fallout from coronavirus may also affect investment income because of the fluctuations in realized and unrealized market losses.

As the virus continues to spread across the globe, the most immediate impact for P&C insurance companies will be in the valuation of equity investments and fixed-income assets, which are affected by equity and bond market volatility. Underwriting results may not be affected materially for the time being. However, claims will start to manifest in some niche industries like hospitality, tourism, transportation, and entertainment as trips and events get canceled or more people become infected.

We consider the coronavirus to be largely an economic event for now, which will not result in significant underwriting losses for the P&C industry overall. However, some lines such as events cancellation and travel insurance will experience an increase in claims.

P&C Coronavirus-Related Claims Will Vary Depending on the type of Product or Industry Sector Covered

Virtually all commercial clients of insurance companies are at risk of experiencing some form of disruption or loss as a result of the coronavirus outbreak. However, not all economic losses will result in claims payouts as this would depend on if a loss is covered by insurance, the type of coverage purchased, and the policy wording, which may have exclusions that limit payouts for the epidemic- related losses.

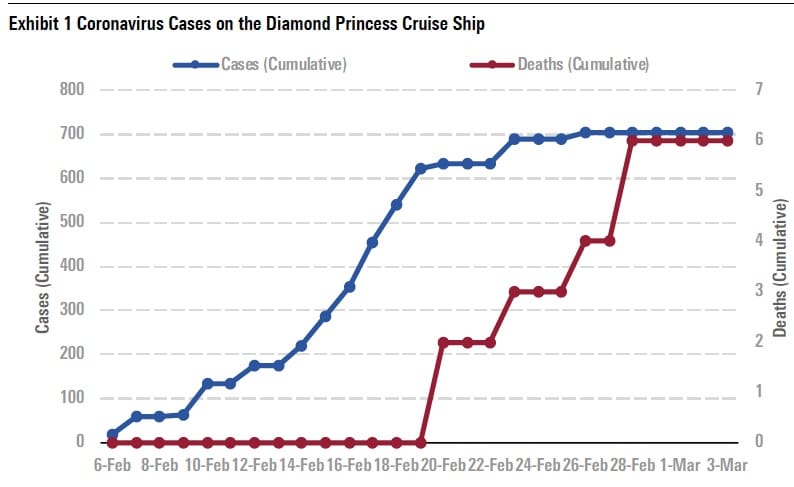

Some organizations have a higher level of exposure compared with others, which include companies in the entertainment industry, large manufacturers, and companies in the tourism and hospitality sectors. This was apparent in the situation of Diamond Princess Cruise ship where the virus spread rapidly within a few days (see Exhibit 1). These organizations either have a large number of people working in concentrated locations or gather a large number of customers physically concentrated in one location— such as in cruise ships, holiday resorts, sports arenas, and theatres—where the significant concentration of people could result in the rapid spread of the virus.

Types of P&C Insurance Policies That Could Be Triggered by Coronavirus

• Event cancellation insurance: This type of coverage provides event organizers with insurance protection against loss of revenue or incremental unforeseen expenses that are caused by uncontrollable circumstances like adverse weather conditions, power failure, postponement, cancellation, terrorism, political activism, or relocation of an event. Many events have been cancelled or postponed by organizations in an attempt to mitigate the spread of the virus, including several Serie A matches in Italy, Facebook’s developers conference, and the Six Nations rugby match between Ireland and Italy.

• Workers’ compensation insurance: In the event of an employee contracting the virus from an infected coworker, the employee could make a workers’ compensation claim for income replacement or medical benefits. We may start seeing these type of claims emerge for assembly line workers, call centres, hotel staff, etc.

• Reesversécherung: This is a product that is offered by both P&C (in some jurisdictions) and life insurance companies. The insurance generally covers flight cancellation; trip interruption; and stolen, lost, or damaged luggage. It also provides cover for delays, medical evacuation, and emergencies. DBRS Morningstar expects that a significant number of travel insurance claims will be reported because of coronavirus-related cancellations.

• Supply chain insurance: This insurance essentially covers business interruption from delay or disruptions in receiving parts, products, components, or services from suppliers. Companies that rely significantly on third-party providers for critical components or service may be able to make claims to recoup losses as a result of the interruption.

• Aner: Other policies that could trigger payouts include (but are not limited to): business interruption, general liability, directors & officers, and pollution liability coverage. However, these would depend heavily on policy wording and any exclusions that may be embedded within the wording.

Investment Income Most Likely to Be Affected in the Short Term

|

P&C insurance companies are major investors in equity and bond markets. The most significant impact of coronavirus in the short term could be in the reporting of investment income as a result of the equity market shocks on the market values of invested assets. The application of fair value accounting standards would result in material movement in realized or unrealized gains because of changes in fair-market values of invested assets. Interest-rate fluctuations would also have an impact on the valuation of fixed-income assets, as various central banks reduce their benchmark rates to try to stimulate economic activity. Exhibit 2 shows the markets have been volatile since January 22, 2020, when the World Health Organization commented on the outbreak of the virus. |

Price Hardening May Mitigate the Impact of Market Volatility on Overall Profitability

P&C insurance companies around the world have been increasing their pricing significantly since 2019, and the trend seems to have continued through to 2020, because of the reduction in capacity and increasing catastrophe losses since 2017. The resulting positive impact on underwriting profitability may help mitigate some of the effects of the coronavirus-driven financial market volatility on investment portfolios, as companies may offset investment losses or depressed investment income with higher underwriting revenues.

DBRS Morningstar is a global credit ratings business with approximately 700 employees in eight offices globally